|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

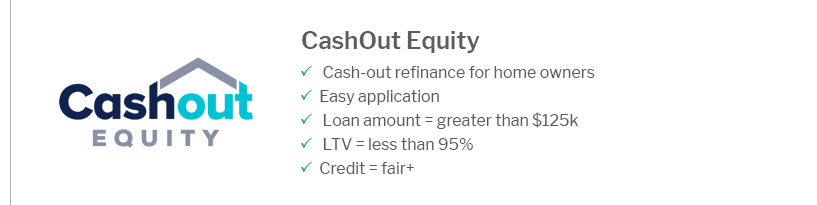

Understanding Home Loan Refinance Interest Rates TodayRefinancing your home loan can be a strategic financial decision, but understanding the current interest rates is crucial. Today, we'll explore what impacts these rates, how you can benefit, and what to consider before refinancing. Factors Influencing Refinance RatesSeveral factors can affect the refinance interest rates offered to you. Let's delve into some of the most significant ones: Credit ScoreYour credit score plays a crucial role. Lenders use it to assess your risk level. Generally, a higher credit score translates to lower interest rates. Loan-to-Value RatioThe loan-to-value (LTV) ratio is another important factor. A lower LTV ratio can help you secure better rates because it indicates lower risk to lenders. Market ConditionsEconomic factors such as inflation, Federal Reserve policies, and the overall economy can influence current interest rates. Keeping an eye on these can help you decide the right time to refinance. Benefits of Refinancing Your Home Loan

Considerations Before RefinancingWhile refinancing can offer several benefits, it's essential to weigh the potential drawbacks:

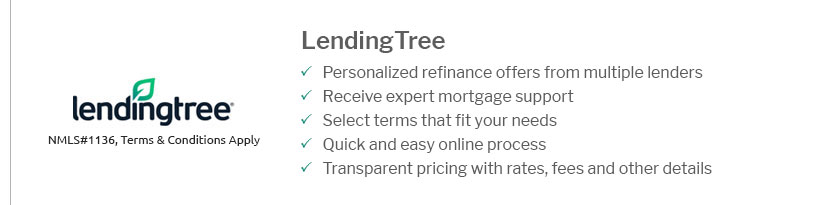

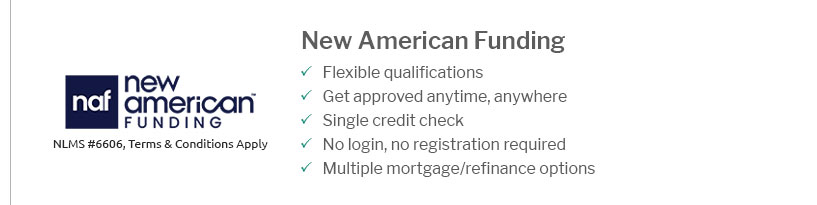

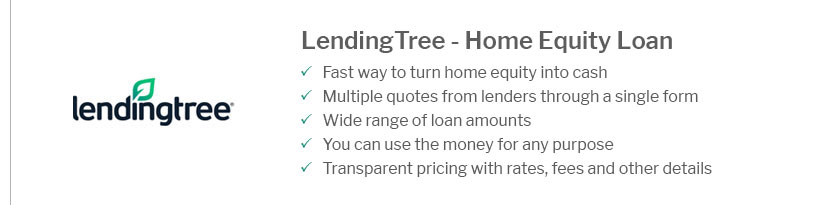

Choosing the right lender is vital. If you're wondering who should I refinance with, it’s wise to compare multiple lenders to find the best rates and terms. FAQ SectionWhat is the current average home loan refinance interest rate?The average refinance rate fluctuates based on market conditions, but as of today, it typically ranges from 3% to 5% depending on your credit profile and loan terms. Is refinancing a good idea in a high-interest environment?Refinancing in a high-interest environment can still be beneficial if your current rate is significantly higher than the market rate or if you aim to switch from an adjustable-rate to a fixed-rate mortgage. How do I know if a 15-year refinance is right for me?A 15-year refinance could be beneficial if you can afford higher monthly payments and want to pay off your mortgage faster. For more details on 15 year refinance rates in California, check the latest offers and compare them with your current loan terms. https://www.bankofamerica.com/mortgage/refinance/

Today's competitive refinance rates ; 30-year fixed - 7.125% - 7.311% - 0.710 ; 15-year fixed - 6.125% - 6.453% - 0.942 ; 5y/6m ARM - 7.250% - 7.382% - 0.887. https://www.wellsfargo.com/mortgage/rates/

Mortgage interest rates today ; 15-Year Fixed Rate - 6.000% - 6.229% ; 30-Year Fixed-Rate VA - 6.250% - 6.462% ; 10/6-Month ARM - 6.875% - 7.127% ; 30-Year Fixed Rate. https://www.usbank.com/home-loans/refinance/refinance-rates.html

Today's 30-year fixed refinance rates ; Conventional fixed-rate loans - 30-year. 7.125%. 7.285%. $3,126 ; Conforming adjustable-rate mortgage (ARM) loans - 10/6 mo.

|

|---|